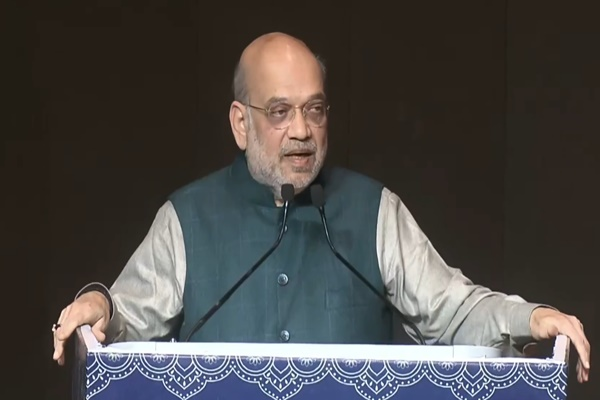

Timely Prevention Crucial to Tackling India’s Growing Cyber Fraud Threat: Amit Shah

- MGMMTeam

- 33 minutes ago

- 4 min read

Union Home Minister Amit Shah has cautioned that cyber fraud in India is rapidly evolving from a financial crime into a serious national security challenge. Addressing a national-level conference on tackling cyber-enabled frauds, Shah stressed that timely prevention and swift intervention are the most effective tools to stop cybercrime from escalating into a full-scale crisis.

With India emerging as one of the world’s largest digital economies, the country now processes billions of online and UPI transactions each year. While this rapid digital expansion has boosted financial inclusion and efficiency, it has also opened new avenues for organised cybercriminal networks to exploit technological vulnerabilities and public unawareness.

Coordinated National Strategy to Dismantle Cybercrime Ecosystems

The Home Minister outlined a comprehensive, multi-agency strategy involving the Ministry of Home Affairs, Indian Cyber Crime Coordination Centre (I4C), Central Bureau of Investigation (CBI), National Investigation Agency (NIA), Reserve Bank of India (RBI), and state police forces. The focus is on strengthening real-time reporting, enhancing digital forensics, building investigative capacity, and promoting nationwide cyber awareness.

Government data shows that the I4C portal has recorded more than 230 million visits since 2020, reflecting the growing dependence of citizens on official cybercrime reporting mechanisms. Over 8.2 million cybercrime complaints have been registered, with a rising number converted into FIRs, indicating both the scale of the problem and improved institutional response.

Rising Losses Despite Significant Fund Recovery

Authorities have been able to safeguard and recover ₹8,189 crore from cyber fraud cases by freezing accounts and intercepting fraudulent transactions. However, estimates suggest that total cyber fraud losses may have reached close to ₹20,000 crore in recent years. This highlights the growing sophistication of fraud networks and the immense financial impact on individuals, businesses, and financial institutions.

Financial fraud now accounts for a majority of cybercrime cases in India. Scams such as fake investment schemes, digital arrest frauds, phishing attacks, social media impersonation, and online marketplace frauds have become increasingly common, targeting citizens across age groups and income levels.

Crackdown on SIM Cards, Devices and Mule Account Networks

As part of intensified enforcement, the Ministry of Home Affairs has cancelled over 12 lakh suspicious SIM cards and blocked more than three lakh mobile device IMEI numbers linked to cybercrime activities. Law enforcement agencies have also arrested over 20,800 accused in cybercrime-related cases, reflecting a sharper operational push to dismantle the infrastructure that enables digital fraud.

A major focus area is the elimination of mule accounts, which are used to route stolen funds through the banking system. In collaboration with the RBI, the government has introduced the ‘Mule Account Hunter’ software to help banks detect and shut down such accounts. By the end of 2025, dozens of banks had been onboarded onto the I4C platform, with plans to bring all financial institutions under this system to strengthen transaction monitoring.

Strengthening Helpline Response and Public Awareness

The national cybercrime helpline 1930 has been highlighted as a critical first-response mechanism. Shah urged state police forces to ensure adequate staffing and faster response times, noting that even small delays can significantly reduce the chances of recovering stolen money. Quick reporting and immediate action are essential to prevent fraudsters from moving funds across multiple accounts.

Alongside enforcement, authorities are placing greater emphasis on public awareness. Cyber experts warn that scammers are increasingly using advanced techniques such as fake law enforcement calls, deepfake videos, and AI-generated phishing messages. This makes citizen awareness and digital hygiene just as important as technological safeguards.

International Cooperation and Institutional Strengthening

Recognising the cross-border nature of cybercrime, Indian agencies are expanding cooperation with international counterparts in countries such as the United States, the United Kingdom, and Japan. The CBI has also launched a dedicated cybercrime wing to strengthen investigations, improve prosecution outcomes, and enhance intelligence-sharing on global cyber fraud syndicates.

Officials believe that international coordination is essential, as many cybercrime networks operate across jurisdictions, using foreign servers, payment channels, and encrypted platforms to evade detection.

The MGMM Outlook

India’s rapidly expanding digital economy has brought immense convenience and financial inclusion, but it has also exposed citizens and institutions to an unprecedented surge in cyber fraud. The warning by Union Home Minister Amit Shah underscores a critical reality: cybercrime is no longer just a financial issue, but a growing national security concern. As UPI, online banking, and digital services become deeply embedded in daily life, organised cybercriminal networks are exploiting gaps in awareness and system vulnerabilities. The scale of losses, despite significant recovery efforts, reflects how sophisticated and widespread these fraud ecosystems have become, impacting individuals, businesses, and the overall trust in digital platforms.

The government’s multi-agency strategy, including stronger coordination through I4C, RBI, and law enforcement, signals a serious institutional push to dismantle cybercrime infrastructure. Measures such as blocking fraudulent SIM cards and devices, targeting mule accounts, strengthening the 1930 helpline, and enhancing international cooperation highlight a comprehensive approach to the threat. However, enforcement alone is not enough. Public awareness, faster reporting, and stronger digital hygiene practices are equally vital to reduce victimisation. Securing India’s digital future will depend on sustained vigilance, advanced technology, and active citizen participation to stay ahead of evolving cyber fraud networks.

(Sources: Hindustan Times, Times of India, News On AIR)

Comments